50 signatures reached

To: Capelli's Period 5 AP Lang Class

It’s Time For The Wealthiest Americans To Pay Their Fair Share

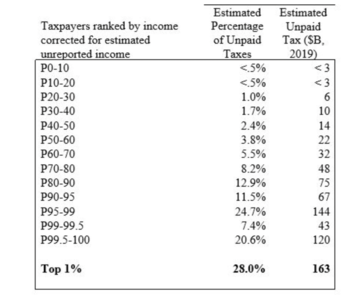

The richest Americans have avoided paying their fair share of taxes at increasing rates over the past few decades. This has caused them to be responsible for $163 billion of lost tax revenue in a single year. Additionally, the standing tax rate for the wealthiest Americans is too low, to begin with, causing the capital of the most opulent Americans to grow at alarming rates. The middle class has suffered as a result of this because as the wealth is redistributed in favor of the super-rich, there is less available capital for them. Therefore, the United States must raise and better enforce taxes on the wealthiest one percent of Americans. Doing so will limit the extreme power that those with a disproportionate amount of wealth have in our capitalistic society and redistribute the wealth in order to make the United States into the opportunity-rich country it claims to be.

Why is this important?

This is important because the United States promotes itself as a democratic country filled with opportunity, and changing the way the nation taxes its wealthiest members will limit their excess of power and redistribute the wealth: allowing American society to live up to these expectations. We must promote legislation that will raise the tax rate for these individuals and elect officials who promise to do so in Congress and the Executive branch. Additionally, it is imperative that we bring attention to the billions of dollars in taxes the opulent are avoiding paying. By spreading awareness on this issue the American people can collectively demand change from our officials. We can also hope that the shame of their sins being publicly exposed will push the top one percent of Americans to start paying their fair share.