25 signatures reached

To: Brian Thomas Moynihan, Chairman and CEO of Bank of America (BofA)

Mr. Moynihan - Stop Blocking BofA Small Businesses Clients from the Paycheck Protection Program

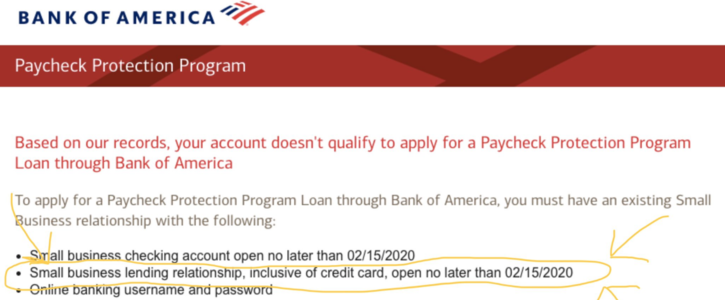

Mr. Moynihan - Bank of America is using redlining practices to block many of their small business clients from applying for the Paycheck Protection Program (PPP) by arbitrarily instituting an unnecessary requirement that they have a LENDING relationship, and not just a small business checking/savings relationship, with the bank in order to even apply for the PPP.

The Paycheck Protection Program is the Federal Government’s emergency program in response to the Coronavirus (COVID-19) Pandemic, designed to keep Small business afloat during this emergency and keep their employees receiving paychecks.

We are petitioning you to eliminate this arbitrary LENDING relationship requirement immediately so that we, the millions of small businesses that do not have lending relationships with BofA, may apply for the PPP program and keep our employees employed and our communities working.

The Paycheck Protection Program is the Federal Government’s emergency program in response to the Coronavirus (COVID-19) Pandemic, designed to keep Small business afloat during this emergency and keep their employees receiving paychecks.

We are petitioning you to eliminate this arbitrary LENDING relationship requirement immediately so that we, the millions of small businesses that do not have lending relationships with BofA, may apply for the PPP program and keep our employees employed and our communities working.

Why is this important?

Small businesses are the engine of our economy. In many communities small businesses are the largest employer and the lifeblood of the community. We create meaningful jobs and opportunities for entrepreneurs to thrive.

By unilaterally requiring that your small business clients have pre-existing lending relationships with Bank of America you are putting up unnecessary roadblocks to saving jobs and saving communities from devastation.

Worse, this practice may even be discriminatory, as it may impact black, Latino, Asian, and Native American business owners disproportionately, who are more likely to have been denied access loans due to historic and current red-lining practices and institutional racism.

The Paycheck Protection Program was designed to provide forgivable loans to Small Businesses to keep people employed during this time of emergency. In determining clients of Bank of America's eligibility for these lifeline loans, you have instituted an unnecessary pre-existing lending client requirement that is preventing many desperate smaller businesses and nonprofits from even applying for PPP.

We all need to come together at times like this, not put up barriers to resources. You have the power to eliminate this arbitrary requirement and we ask you to step in and address this issue with the urgency the present emergency demands.

By unilaterally requiring that your small business clients have pre-existing lending relationships with Bank of America you are putting up unnecessary roadblocks to saving jobs and saving communities from devastation.

Worse, this practice may even be discriminatory, as it may impact black, Latino, Asian, and Native American business owners disproportionately, who are more likely to have been denied access loans due to historic and current red-lining practices and institutional racism.

The Paycheck Protection Program was designed to provide forgivable loans to Small Businesses to keep people employed during this time of emergency. In determining clients of Bank of America's eligibility for these lifeline loans, you have instituted an unnecessary pre-existing lending client requirement that is preventing many desperate smaller businesses and nonprofits from even applying for PPP.

We all need to come together at times like this, not put up barriers to resources. You have the power to eliminate this arbitrary requirement and we ask you to step in and address this issue with the urgency the present emergency demands.