1,000 signatures reached

To: Michigan Governor Gretchen Whitmer

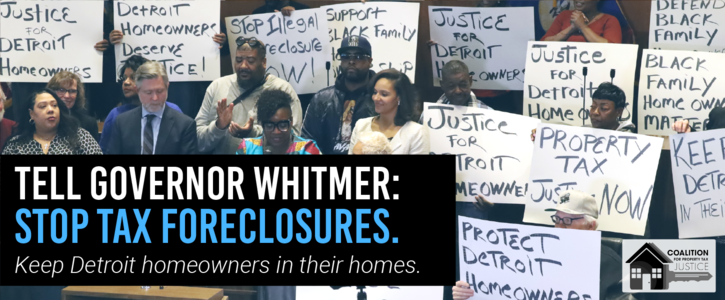

Stop Illegally Inflated Property Taxes in Detroit

Establish a task force to investigate and stop inflated property taxes in Detroit.

Why is this important?

It's not just COVID and police brutality exposing racism in America. Black homeowners in Detroit are being overtaxed on top of these other injustices.

We’ve all seen headlines about Detroit homeowners being overcharged $600 million dollars in property taxes. No community should be hit with such unjust bills and least of all a city with 40 percent of residents struggling in poverty. Detroit has one of the highest property tax foreclosure rates of any city since the Great Depression.

A recent University of Chicago study shows that, even after Mayor Duggan tried to fix the problem, the City is still overcharging the lowest valued homes. These are deep, systemic problems that a task force should investigate, propose solutions to end the practice and help make the community whole.

Governor Whitmer has proven that she can get the job done with COVID and is with us in the movement against police brutality. Now it's time to do the same for property tax injustice. We call on her to create a task force to investigate and stop unfair property tax practices and keep Detroit homeowners in their homes.

Sources:

https://harris.uchicago.edu/files/evalrespropertytaxasdetroit20162018.pdf

https://scholarship.law.uci.edu/ucilr/vol9/iss4/3/

http://www.californialawreview.org/print/predatory-cities/#_ftn18

https://www.nytimes.com/2020/06/11/opinion/coronavirus-cities-property-taxes.html

We’ve all seen headlines about Detroit homeowners being overcharged $600 million dollars in property taxes. No community should be hit with such unjust bills and least of all a city with 40 percent of residents struggling in poverty. Detroit has one of the highest property tax foreclosure rates of any city since the Great Depression.

A recent University of Chicago study shows that, even after Mayor Duggan tried to fix the problem, the City is still overcharging the lowest valued homes. These are deep, systemic problems that a task force should investigate, propose solutions to end the practice and help make the community whole.

Governor Whitmer has proven that she can get the job done with COVID and is with us in the movement against police brutality. Now it's time to do the same for property tax injustice. We call on her to create a task force to investigate and stop unfair property tax practices and keep Detroit homeowners in their homes.

Sources:

https://harris.uchicago.edu/files/evalrespropertytaxasdetroit20162018.pdf

https://scholarship.law.uci.edu/ucilr/vol9/iss4/3/

http://www.californialawreview.org/print/predatory-cities/#_ftn18

https://www.nytimes.com/2020/06/11/opinion/coronavirus-cities-property-taxes.html